Credit scores are calculated using various factors, but the exact methods may vary depending on the credit scoring model. Generally, factors like payment history, credit utilization, length of credit history, types of credit, and new credit applications are considered. Payment history and credit utilization are typically the most significant factors. It’s essential to make payments on time and keep credit card balances low to maintain a good credit score.

THE BASICS

There can be several reasons why your credit scores may vary between different sources or scoring models. Here are some common factors that can contribute to score differences:

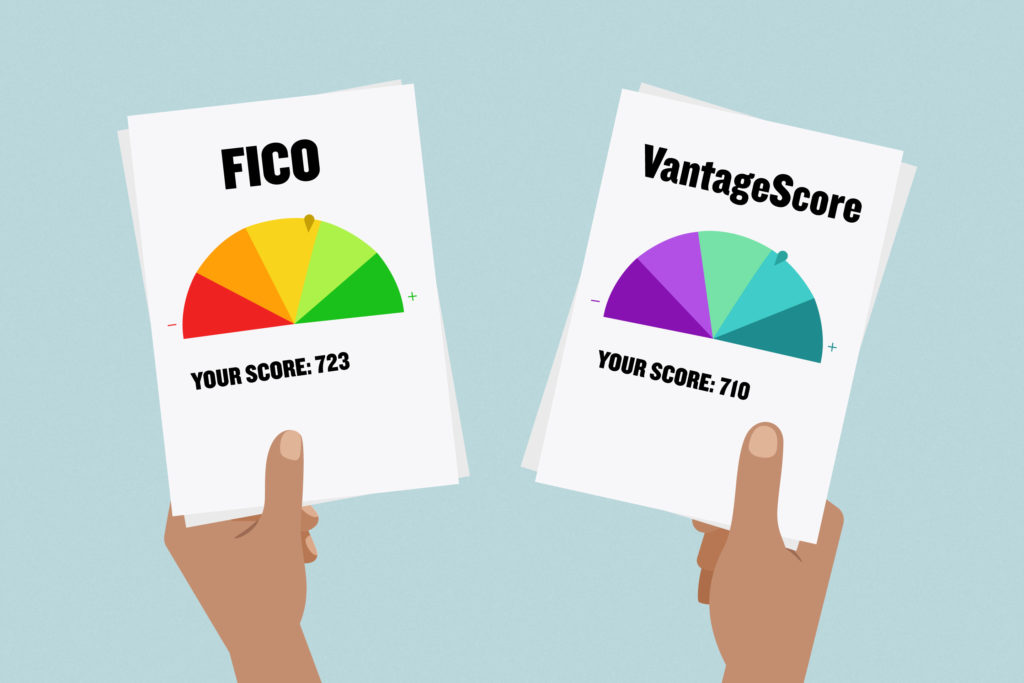

Credit scores can be calculated using various scoring models, such as FICO Score or VantageScore. Each model may have its own algorithms and weightings for different credit factors, leading to score variations.

Credit scores are based on the information in your credit reports, which are compiled by credit bureaus (Experian, Equifax, TransUnion). Not all lenders report to all three bureaus, so the data in your reports may differ, resulting in score disparities.

Lenders may report updates to credit bureaus at different times, leading to temporary score differences. If a lender reports changes to one bureau but not others, it can affect the scores until all bureaus receive the updated information.

Credit utilization, the ratio of credit card balances to credit limits, can vary depending on when lenders report this information. If balances are reported at different times during the billing cycle, it can impact credit scores.

Different scoring models may have different score ranges. While most commonly used models range from 300 to 850, there can be variations, and certain industries may use customized scoring models with different ranges.

Credit scoring models consider various factors, including payment history, credit utilization, length of credit history, types of credit, and new credit applications. Differences in these factors among your credit reports can contribute to score variations.

SCORING MODELS

VantageScore was jointly developed by the three major credit bureaus (Experian, Equifax, and TransUnion), while FICO Score was created by the Fair Isaac Corporation.

VantageScore ranges from 300 to 850, with higher scores indicating better creditworthiness. FICO Score ranges from 300 to 850 as well, but there are also industry-specific FICO Score versions with different ranges.

VantageScore and FICO Score use different algorithms to calculate credit scores. While both consider similar factors like payment history and credit utilization, the weight assigned to each factor may vary.

VantageScore requires at least one month of credit history and one account reported within the past two years. FICO Score typically requires at least six months of credit history and one account reported within the past six months.

FICO Score is more widely used by lenders, while VantageScore has been gaining popularity in recent years.

It’s important to note that the specific versions of VantageScore and FICO Score used by lenders may differ, so credit scores can vary between the two models.

CREDIT REPORTS

You can obtain your credit report from the three major credit bureaus: Experian, Equifax, and

TransUnion. The easiest way to access your credit report is through AnnualCreditReport.com, a website authorized by the federal government. By law, you are entitled to one free credit report from each bureau every 12 months. You can request all three reports at once or stagger them throughout the year for continuous monitoring. Additionally, you can also consider using various online services that provide credit monitoring and access to your credit reports.

As a client, you will be required to enroll in credit monitoring through our partner Smart Credit as it is the only credit monitoring compatible with our software. If you have any questions regarding this please do not hesitate to contact us!

Reading a credit report can seem overwhelming, but here are some key steps to help you navigate it effectively:

Review your personal details, such as name, address, and social security number, to ensure accuracy.

Look for a summary section that provides an overview of your accounts, including the number of open and closed accounts, total debt, and available credit.

Examine each account individually. Note the creditor's name, type of account (credit card, loan, etc.), account number, balance, payment history, and status (open, closed, etc.). Pay attention

Check for a section that lists recent inquiries made by lenders when you applied for credit. Inquiries may be categorized as hard inquiries (initiated by you) or soft inquiries (initiated by companies for promotional purposes). Multiple hard inquiries within a short period can slightly impact your credit score.

If applicable, review any public records such as bankruptcies, tax liens, or judgments. These records can significantly impact your creditworthiness.

If you spot any inaccuracies, such as accounts you don't recognize, incorrect balances, or outdated information, take note of them. You have the right to dispute errors with the credit bureau, and they must investigate and correct any verified inaccuracies.

Some credit reports may include your credit score. Understand that different scoring models may yield different scores, so it's helpful to focus on the overall credit report information rather than just the score.

Remember to review your credit report from all three major credit bureaus (Experian, Equifax, and TransUnion) as the information may vary slightly. Regularly monitoring your credit report can help you identify issues, track your financial progress, and ensure the accuracy of your

credit information.

REPORT ERRORS

FCRA

The Fair Credit Reporting Act (FCRA) grants consumers several important rights regarding their credit information. Some of the key rights outlined in the FCRA include:

You have the right to request and obtain a free copy of your credit report from each of the three major credit bureaus once every 12 months through AnnualCreditReport.com.

If you believe there is inaccurate or incomplete information on your credit report, you have the right to dispute it with the credit bureau. They must investigate and correct any errors within a reasonable timeframe.

If a negative action, such as denial of credit or employment, is taken against you based on information in your credit report, the entity responsible must provide you with a notice that includes the specific reasons for the adverse action.

In most cases, entities need your consent to access your credit report for purposes such

Generally, only entities with a valid purpose, such as lenders, landlords, or employers, can access

The FCRA provides provisions to help protect consumers against identity theft, including the placement of fraud alerts, extended fraud alerts, and the ability to request a credit freeze.

It’s important to review the full text of the Fair Credit Reporting Act or consult with legal

professionals.

FAIR DEBT COLLECTION PRACTICES ACT

The Fair Debt Collection Practices Act (FDCPA) is a federal law that provides important consumer rights and protections when dealing with debt collectors. Here are some of the key rights outlined in the FDCPA:

Debt collectors cannot engage in harassing, abusive, or threatening behavior when attempting to collect a debt. They must communicate with you respectfully and at reasonable times.

Upon your request, debt collectors must provide written verification of the debt, including the amount owed and the name of the original creditor. You have the right to dispute the debt if you believe it is inaccurate or if you require more information.

You have the right to request that a debt collector stop contacting you. Once you make this request in writing, the debt collector can only contact you to inform you about specific actions they will take, such as filing a lawsuit.

If you dispute a debt within 30 days of receiving the initial written notice, the debt collector must provide you with the name and address of the original creditor.

Debt collectors cannot use deceptive or misleading tactics, such as falsely representing the amount owed, making false threats of legal action, or misrepresenting their identity or affiliation.

If a debt collector violates the FDCPA, you have the right to sue them in a court of law within one year from the date of the violation. You may be entitled to damages, including actual damages, statutory damages, and attorney's fees.

It’s important to familiarize yourself with the full text of the Fair Debt Collection Practices Act or consult legal professionals to understand your rights and protections in debt collection

situations.

Give us a call